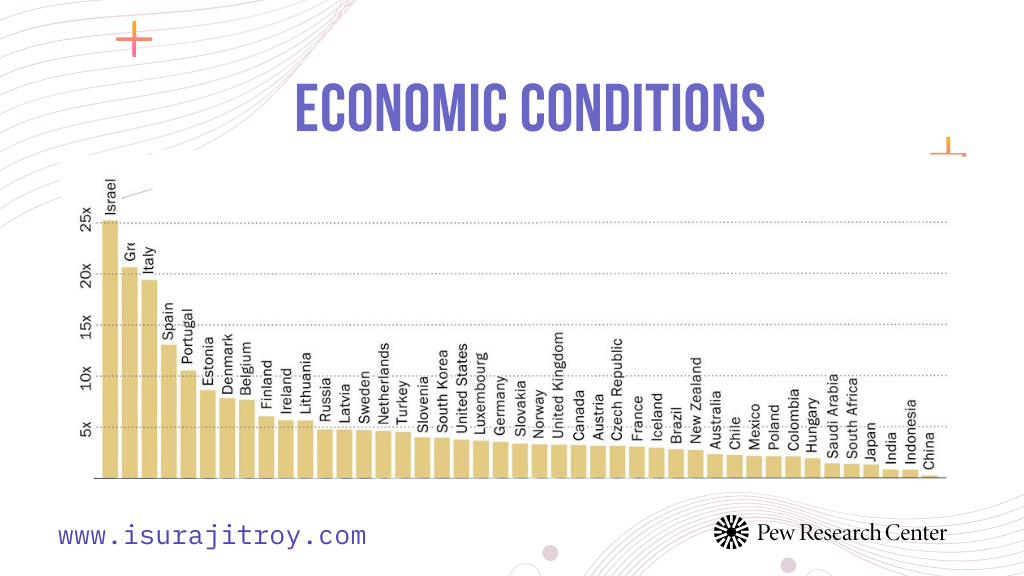

According to the data, which was released (23-June-2022) by the World Economic Forum (taken help of Pew Research Center), two years ago, there were a lot of people out of work and central bankers and politicians were trying to make the economy better. They thought that inflation (prices going up) was not a big deal.

A year later, there were still some people out of work, but the inflation rate (how much prices went up) was rising. Many of those same policy makers said that the price hikes were only temporary and would fix themselves soon.

Inflation is when the prices of things go up. A pandemic is when a lot of people get sick at the same time. A recession is when the economy is not doing well. It can cause people to feel stressed because it means they have to spend more money on things. In a survey, 87% of people said that inflation is a big source of stress.

Now it is becoming clear that inflation is not temporary.

Financial stress – Definition and Effects

Financial stress is the feeling of being overwhelmed by your financial obligations. It can cause you to feel anxious, helpless, and hopeless. Financial stress can lead to physical and mental health problems, and it can make it difficult to focus on other aspects of your life.

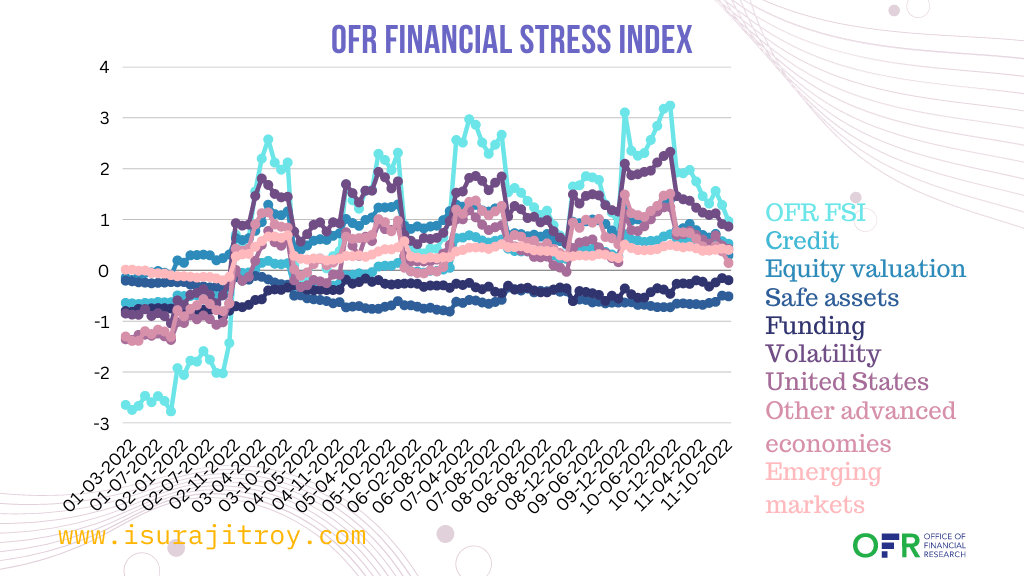

The OFR Financial Stress Index is a way of measuring how stressed the financial markets are. It uses 33 different variables to do this, such as yield spreads and interest rates. A positive number means that the markets are more stressed than usual, while a negative number means that the markets are less stressed than usual.

It’s no secret that money can be a major source of stress in our lives. Whether we’re worrying about making ends meet, trying to get out of debt, or simply trying to save for a rainy day, financial stress can take a major toll on our mental and physical health.

And it’s not just adults who are feeling the pinch. A recent study found that nearly half of all children in the United States are worried about their family’s financial situation.

Inflation and unemployment

Inflation and unemployment are two of the most important economic indicators. They are closely related and can have a big impact on the economy. Inflation and unemployment can have a big impact on your life. If inflation is high, it can eat into your savings. And if unemployment is high, it can be hard to find a job.

According to a Forbes article, Inflation is when the prices of things go up. A low level of inflation is when the prices of things go up a little bit each year. This is good for the economy because it means that people have more money to spend. The Federal Reserve tries to keep inflation at 2% each year. But if inflation goes up too much, it can hurt the economy.

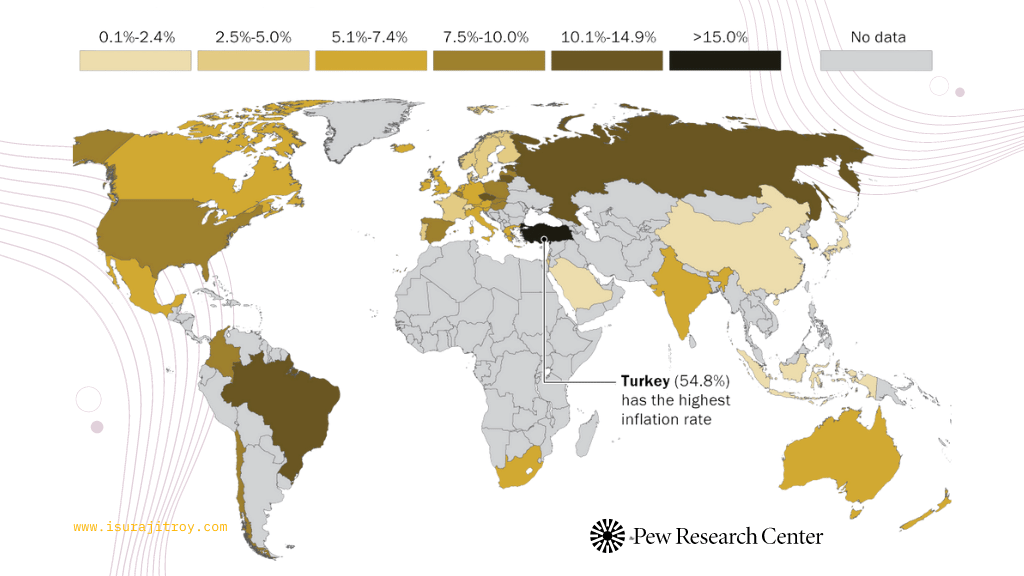

Pew Research Center says, the inflation rate in the US was 8.6% in May, which is the highest it’s been since 1981. In 37 of the 44 nations that were looked at, the average annual inflation rate in the first quarter of this year was at least twice what it was in the first quarter of 2020. In 16 countries, first-quarter inflation was more than four times the level of two years prior.

Turkey has the highest inflation rate out of all the countries that were studied. This means that prices in Turkey are rising very quickly. The government is doing things that are making it worse, like cutting interest rates.

In general, inflationary pressures tend to put upward pressure on unemployment. This is because businesses may be hesitant to invest and expand when they anticipate prices will rise in the future. This can lead to a decrease in demand for labor, and therefore, an increase in unemployment.

However, there are times when inflation can actually help to reduce unemployment. This is most likely to occur when there is significant slack in the economy, and inflation is expected to be relatively low. In this case, the boost to aggregate demand from higher prices can help to spur economic activity and reduce unemployment.

The unemployment rate is the percentage of people who don’t have a job but are able and willing to work. The global unemployment rate for 2021 is estimated to be between 6.3% and 6.5%. The unemployment rate is a lagging indicator, which means it goes up or down in response to changing economic conditions instead of predicting or influencing them. The unemployment rate is the number of people who are looking for a job but don’t have one, divided by the number of people in the labor force. The labor force is the number of people who are either working or looking for a job.

Financial stress and mental health

If you’re like most people, you worry about money. In fact, financial stress is one of the leading causes of anxiety and depression. Money troubles can cause all sorts of mental and emotional problems, from sleepless nights to panic attacks.

For most of us, managing our finances can be a source of stress. This is particularly true when we’re struggling to make ends meet. Financial stress can take a toll on our mental and emotional health, causing anxiety, depression, and even physical symptoms.

Money stress

Are you one of the many Americans who are stressed about money? If so, you’re not alone. Money is a leading cause of stress for Americans, according to a recent poll. And it’s no wonder, with the economy still struggling and many people living paycheck to paycheck.

Financial stress symptoms

Financial stress can take a toll on our physical and mental health. Some common symptoms include anxiety, depression, trouble sleeping, and difficulty concentrating. If you’re experiencing any of these symptoms, it’s important to talk to someone who can help you manage your finances and ease your stress.

Money stress depression

There is no definitive answer to this question, as it is not an official medical diagnosis. However, some experts believe that money stress depression may be a form of anxiety or depression that is triggered by stress related to finances. This can include stress from worrying about money, or from dealing with financial problems. Money stress depression may cause someone to feel overwhelmed, anxious, and hopeless. It can also lead to physical symptoms such as headaches, stomach problems, and insomnia. If you are experiencing symptoms of money stress depression, it is important to talk to a mental health professional to get help.

Debt stress

Debt stress is a type of financial stress that can be caused by having too much debt. This can be caused by a variety of factors, including high interest rates, missed payments, or a sudden loss of income. Debt stress can lead to a number of negative consequences, including anxiety, depression, and financial problems.

Financial PTSD

Financial PTSD is a condition that can develop in individuals who have experienced a traumatic financial event. This can include things like job loss, foreclosure, or bankruptcy. Symptoms may include anxiety, depression, and difficulty trusting others. Treatment often includes therapy and financial education.

Stressed over money

When someone is stressed over money, it means that they are worried about their financial situation and whether or not they will be able to afford their expenses. This can be a result of a variety of factors, such as job insecurity, unexpected expenses, or simply not having enough money to cover all of one’s bills. Whatever the cause, stress over money can lead to a great deal of anxiety and can even affect one’s physical health.

Historical inflation rates

World Inflation Rate 1981-2022

According to Mecrotrends and The World Bank data,

- World inflation rate for 2021 was 3.42%, a 1.5% increase from 2020.

- World inflation rate for 2020 was 1.92%, a 0.27% decline from 2019.

- World inflation rate for 2019 was 2.19%, a 0.25% decline from 2018.

- World inflation rate for 2018 was 2.44%, a 0.25% increase from 2017.

Global inflation forecast from 2023 to 2027

The World Economic Outlook is a database that contains information on the global economy. It is released twice a year, in April and September/October. The International Monetary Fund (IMF) is an organization that provides data on the economies of different countries. This database allows users to find information on topics such as national accounts, inflation, unemployment rates, balance of payments, fiscal indicators, trade, and commodity prices.

Unemployment and mental health

The long-term effects of unemployment on mental health are well documented. Studies show that unemployed adults are more likely to experience depression, anxiety, and other mental health problems. The psychological effects of unemployment can be just as damaging as the financial ones. Job loss can lead to feelings of failure, self-doubt, and worthlessness. It can also cause relationship problems and increase the risk of substance abuse.

Unemployment can have a major impact on mental health. The stress of job loss can lead to depression, anxiety, and other mental health problems. If you’re unemployed, it’s important to take care of yourself and seek help if you need it.

There are a number of ways to cope with the psychological effects of unemployment. Here are some tips:

- Acknowledge your feelings. It’s normal to feel sad, anxious, or angry when you lose your job. It’s important to express your emotions in a healthy way.

- Stay connected. Spend time with family and friends. Join a support group.

- Take care of yourself. Eat healthy, exercise, and get plenty of sleep.

- Seek professional help. If you’re struggling to cope, talk to a therapist or counselor.

If you’re unemployed, you’re not alone. Millions of people are out of work, and many are struggling to cope with the psychological effects of unemployment. But there are things you can do to help yourself. By taking care of yourself and seeking professional help if you need it, you can get through this tough time.

Financial wellness tips

Financial wellness is a state of being in which one’s financial situation is manageable and free from stress. It is a state of financial health that is achieved through responsible money management and planning.

Manage money better

There is no one-size-fits-all answer to this question, as everyone’s financial situation is unique. However, some tips on how to manage your money better include creating a budget, tracking your spending, and setting financial goals. Additionally, you may want to consider seeking out professional financial advice if you are struggling to get a handle on your finances.

Make money work for you.

The best way to make money work for you depends on your individual circumstances and goals. However, some general tips on how to make money work for you include:

Invest in yourself and your education: One of the best ways to make money work for you is to invest in yourself and your education. By acquiring new skills and knowledge, you will be better equipped to earn a higher income and achieve your financial goals.

Invest in assets: Another way to make money work for you is to invest in assets such as property or stocks and shares. Over time, these assets will typically increase in value, providing you with a valuable source of income.

Live below your means: One of the simplest but most effective ways to make money work for you is to live below your means. By spending less than you earn, you will be able to save money which can be used to invest in your future.

Financial literacy skills.

Best way to improve financial literacy skills will vary depending on the individual’s current level of knowledge and understanding. However, some tips on how to improve financial literacy skills include:

- Reading books or articles on personal finance.

- Taking a personal finance class.

- Working with a financial planner or coach.

- Practicing financial literacy skills through budgeting and goal-setting.

Family financial guide

If you are struggling to make ends meet, you are not alone. Millions of American families are living paycheck to paycheck, and many are one unexpected expense away from financial disaster.

There is no one-size-fits-all solution to getting your finances in order, but there are some basic steps you can take to get started.

- Track your spending. For one week, write down everything you spend. At the end of the week, review your spending and look for areas where you can cut back.

- Make a budget. Once you know where your money is going, you can start to make a budget. Track your income and expenses, and make sure your spending does not exceed your income.

- Save money. Begin to build up an emergency fund to cover unexpected expenses. Aim to save at least 3-6 months of living expenses.

- Invest in yourself. Investing in your education and career can pay off in the long run. Consider taking courses or pursuing a degree that will help you earn more money.

- Live below your means. Make sure your lifestyle does not exceed your income. If you cannot afford something, do without it or look for a less expensive alternative.

Ways to reduce debt

There are many ways to reduce debt. Some methods are more effective than others, and some require more effort than others.

1. Create a budget and stick to it.

One of the most effective ways to reduce debt is to create a budget and stick to it. This will allow you to see where your money is going and where you can cut back.

2. Negotiate with creditors.

If you are unable to make your monthly payments, you may be able to negotiate with your creditors to reduce your debt. This can be a successful method, but it may take some time.

3.Consolidate your debt.

If you have multiple debts, you may be able to consolidate them into one loan. This can reduce your monthly payments and make it easier to pay off your debt.

4.Use a debt management plan.

If you are struggling to repay your debt, you may be able to enroll in a debt management plan. This plan will help you make payments to your creditors and will also reduce your interest rates.

5. File for bankruptcy.

Filing for bankruptcy should be a last resort. However, if you are unable to repay your debt, this may be the best option for you.

Conclusion

It’s no secret that financial stress can have a serious impact on mental health. And, as if that weren’t enough, inflation can make that stress even worse. That’s because when prices go up, incomes usually don’t keep pace. That means people have to spend more of their hard-earned money just to keep up with the cost of living. And that can lead to all sorts of problems, from anxiety and depression to sleeplessness and even substance abuse. If you’re struggling to keep up with the bills, it’s important to reach out for help. There are plenty of resources available to assist you, and getting some extra support can make a world of difference.

Guter Beitrag! Wir werden diesen besonders großartigen Beitrag auf unserer Website verlinken. Weiter so.