Disclaimer: The information contained in this document is for educational and informational purposes only and should not be construed as investment advice. I am not registered with the Securities and Exchange Board of India (SEBI) as a financial advisor. This is not a recommendation to buy or sell any security. Before investing in any security, you should consult with a qualified financial advisor to determine if the investment is suitable for your investment objectives and risk tolerance. Investing in the stock market is subject to market risks.

Short selling is a powerful day trading technique that allows traders to profit from falling prices. Unlike buying (going long), short selling involves selling a stock you don’t own, expecting to buy it back at a lower price. This article breaks down the mathematics, strategies, and chart analysis behind short selling for intraday profits.

What is Short Selling?

Short selling involves:

- Borrowing shares from a broker.

- Selling them at the current market price.

- Repurchasing them (buying to cover) at a lower price.

- Returning the borrowed shares.

Profit Calculation:

Profit=(Sell Price−Buy Price)×Number of Shares−Fees

📌 Example:

- Sell at $100

- Buy back at $95

- Shares: 100

Profit=(100−95)×100=$500

Key Risks

Unlimited Loss: If the stock rises instead of falling, losses can be infinite.

Short Squeeze: Rapid upward price movement due to heavy short covering.

Borrow Availability: Not all stocks are available to short.

Chart Patterns for Short Selling

1. Bear Flag Pattern

- Downtrend → brief consolidation → continuation of the fall.

- Ideal for entering short at the breakout below consolidation.

🔎 Chart Signals:

- Tight price channel upward during consolidation.

- Breakout on increasing volume.

2. Breakdown Below Support

- A strong support level breaks with volume.

- Entry below the breakdown line.

🔢 Risk/Reward Ratio Example:

- Entry: $50

- Stop loss: $52

- Target: $46

Risk=52−50=2Reward=50−46=4⇒R/R Ratio=1:2

3. Gap and Fade

- Stock gaps up due to news → fades throughout the day.

- Traders short the fade when momentum stalls.

✅ Ideal Setup:

- Low float stock.

- Overbought RSI (>70).

- Bearish divergence.

Indicators & Tools

| Indicator | Use Case in Shorting |

|---|---|

| RSI | Overbought = short signal |

| VWAP | Short below VWAP |

| MACD | Bearish crossover confirmation |

| Volume Profile | High-volume breakdown zones |

Position Sizing Formula

Position Size= (Account Risk %×Account Size)/Stop Loss Per Share

📌 Example:

- Risk: 1% of $10,000 = $100

- Stop loss: $2/share

Position Size= (100/2) = 50 shares

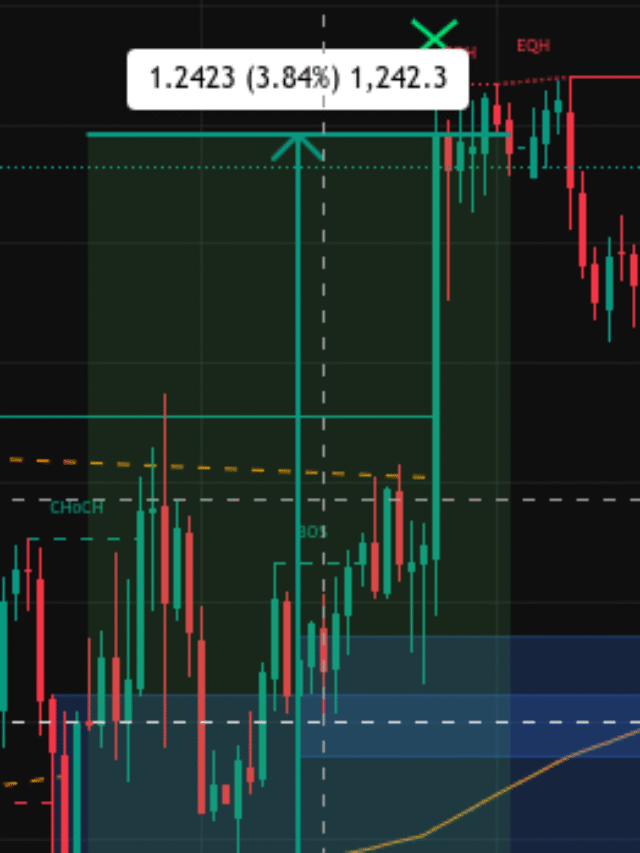

Real-World Chart Breakdown

Let’s take an example (e.g., AAPL) with a support breakdown:

- Entry: Below $165 support

- Stop Loss: Above $166.5

- Exit: $160

- Entry Trigger: Increased volume + RSI crossing below 50

💡 Tip: Look for volume confirmation. If volume increases on the breakdown, the move is likely strong.

Short Selling Strategy Checklist

- Identify bearish pattern (flag, double top, etc.)

- Check volume, RSI, and VWAP positioning

- Set clear stop-loss and take-profit levels

- Calculate position size using risk management

- Monitor for short squeeze signals

Conclusion

Short selling is not just betting against a stock—it’s a strategic, calculated approach to profit in declining markets. Mastering chart patterns, volume analysis, and risk management is crucial. With discipline, short selling can be a core weapon in a day trader’s arsenal.