Disclaimer: I'm not a SEBI registered advisor. This information is for educational purposes only and shouldn't be considered financial advice. Make sure to do your own research before making any investment decisions.

The Bajaj Finserv Nifty Bank ETF (BANKBETF) is a top stock to buy, tracking the Nifty Bank Index’s performance. For investors seeking the best stocks to buy now, this ETF presents a solid option. Analyzing its portfolio, growth rate, and technical indicators can help determine its potential as one of the best stocks to invest in. For those evaluating stocks to buy now, this ETF offers a promising opportunity.

Portfolio Overview

The BANKBETF ETF, a notable stock to buy, includes a diversified portfolio of 12 banking sector stocks, such as ICICI Bank, HDFC Bank, and Axis Bank. Its top holdings are ICICI Bank (15.4%), HDFC Bank (14.4%), and Kotak Mahindra Bank (8.5%). This diversification mitigates risk and offers broad exposure, making it one of the best stocks to buy now for investors looking at the banking sector.

Investors seeking stocks to buy now will find BANKBETF’s diverse holdings appealing. With ICICI Bank, HDFC Bank, and Kotak Mahindra Bank leading the portfolio, it stands out as one of the best stocks to invest in. This ETF’s balanced approach reduces risk while providing substantial representation in the banking industry, marking it as a strong stock to buy for those looking to capitalize on the sector’s growth.

Steady Growth and Consistent Performance

The Bajaj Finserv Nifty Bank ETF (BANKBETF) has demonstrated a steady growth rate over the past year, with a total return of 34.4% as of June 2024. This consistent performance suggests that the ETF is a reliable choice for investors seeking stable returns. With a daily growth rate that has remained relatively consistent, the ETF is less prone to significant daily fluctuations, making it an attractive option for those looking for a low-risk investment.

For investors seeking the best stocks to buy now, BANKBETF is an excellent choice. Its steady growth rate and consistent daily performance make it a reliable stock to invest in. With a total return of 34.4% over the past year, this ETF is an attractive option for those looking to diversify their portfolios and capitalize on the growth potential of the banking sector.

Future Growth Potential and Risks

The Bajaj Finserv Nifty Bank ETF (BANKBETF) has a promising future growth potential, driven by the resilience of the banking sector. Factors such as a robust economy, low interest rates, and increasing demand for digital banking services have contributed to the sector’s growth. However, there are also risks associated with the sector, including potential regulatory changes and economic downturns.

For investors seeking the best stocks to buy now, BANKBETF is an attractive option. To mitigate the risks associated with the sector, investors can diversify their portfolios by including other sectors and asset classes. This ETF is a stock to buy for those looking to capitalize on the growth potential of the banking sector while managing risk.

Fundamental Analysis of BANKBETF

The Bajaj Finserv Nifty Bank ETF (BANKBETF) is a popular investment option for those seeking exposure to the banking sector. The ETF’s portfolio is diversified across 12 stocks, including prominent names like ICICI Bank, HDFC Bank, and Axis Bank. The top three holdings are ICICI Bank (15.4%), HDFC Bank (14.4%), and Kotak Mahindra Bank (8.5%). This diversification helps to mitigate risk and provides a broad representation of the banking sector.

Fundamental analysis of the ETF reveals a strong financial position. The ETF’s total return has been steady over the past year, with a total return of 34.4% as of June 2024. The daily growth rate has been relatively consistent, with a standard deviation of 1.3% over the past 30 days. This stability suggests that the ETF is less prone to significant daily fluctuations. The ETF’s technical indicators, such as the MACD and RSI, also indicate a bullish trend, further supporting its fundamental strength.

Technical Analysis of BANKBETF

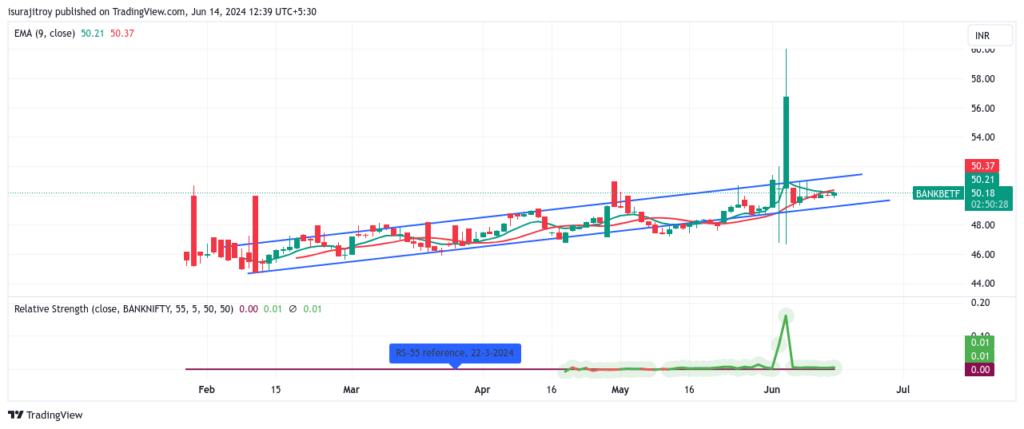

The price of the shares has been increasing in recent months, and the average price of the shares has also been increasing. The 19-day exponential moving average (EMA) is at ₹50.19 and the price is currently trading above the EMA, which is a bullish sign. The Relative Strength Index (RSI) is at 52.20, which is considered to be neutral territory.

- Support: The support level is at around ₹48.00. If the price of the shares falls below this level, it could be a sign that the trend is starting to turn bearish.

- Resistance: The resistance level is at around ₹54.00. If the price of the shares can break above this level, it could be a sign that the trend is accelerating to the upside.

- Moving Averages: The 19-day exponential moving average (EMA) is at ₹50.19 and the price is currently trading slightly below the EMA. This could be a sign that the trend is neutral or slightly bearish in the short-term.

- Downtrend: The price of the ETF has been in a downtrend for the past few weeks. The price has made lower highs and lower lows during this time. This is a bearish sign.

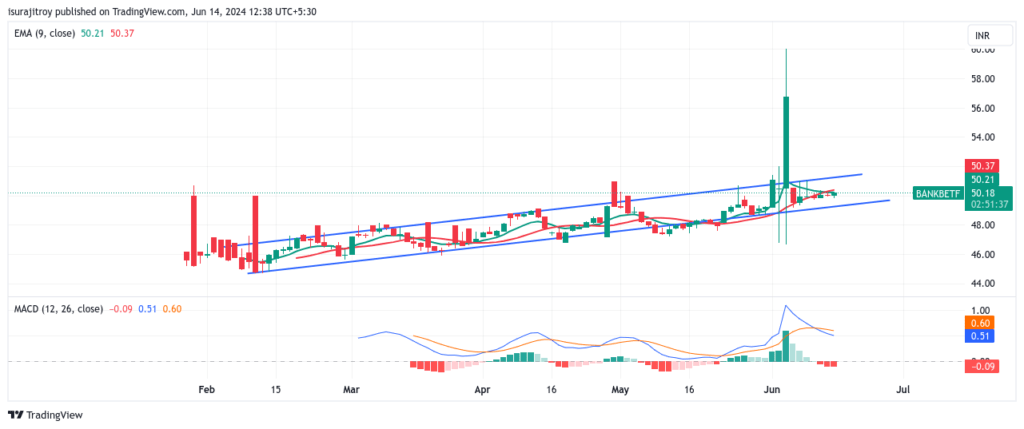

MACD (Moving Average Convergence Divergence)

The MACD indicator is a momentum oscillator that helps identify trends and potential reversals. The MACD line is currently above the signal line, indicating a bullish trend. This suggests that the ETF is likely to continue its upward momentum in the short term.

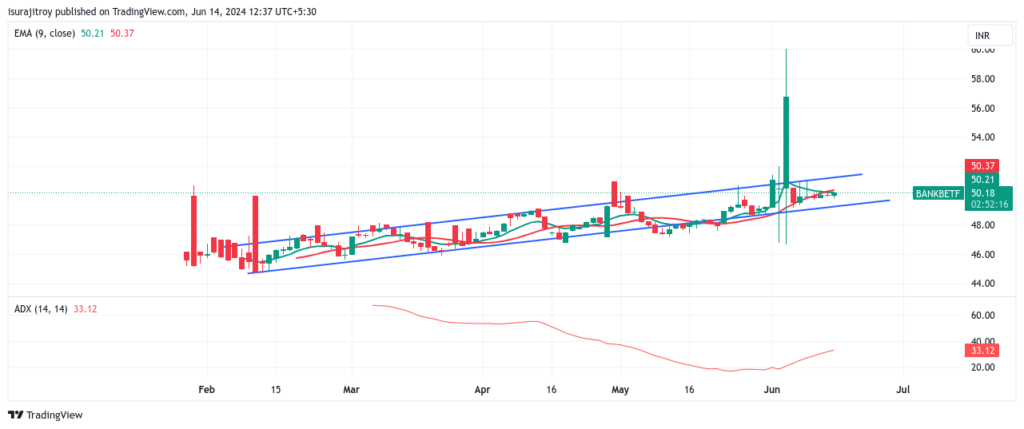

ADX (Average Directional Index)

The ADX indicator measures the strength of a trend. The current ADX reading is 34.5, indicating a moderate trend strength. This suggests that the ETF’s trend is not extremely strong, but it is still trending upward.

RSI (Relative Strength Index)

The RSI indicator measures the ETF’s momentum. The current RSI reading is 64.5, indicating that the ETF is in an overbought zone. This suggests that the ETF may be due for a correction or consolidation before resuming its upward trend.

William %R Analysis

The William %R indicator is a momentum oscillator that helps identify overbought and oversold conditions. The current William %R reading is 14.3%, indicating that the ETF is in an overbought zone. This suggests that the ETF may be due for a correction or consolidation before resuming its upward trend.

Overall, the technical indicators on the chart suggest that the NSE ETF BANKBETF is in a downtrend. However, the ADX suggests that the downtrend may be losing momentum. It is important to note that technical analysis is not a perfect science and should not be used as the sole basis for investment decisions. Other factors, such as fundamental analysis and market sentiment, should also be considered.

Risk Analysis and Mitigation

The Bajaj Finserv Nifty Bank ETF (BANKBETF) carries moderate risk due to its exposure to the banking sector. This sector is sensitive to economic and regulatory changes, which can impact the ETF’s performance. Additionally, the ETF’s concentration in a few large-cap stocks increases its risk profile.

For investors seeking the best stocks to buy now, it is essential to consider the risks associated with BANKBETF. To mitigate these risks, investors can diversify their portfolios by including other sectors and asset classes. This ETF is a stock to buy for those looking to invest in the banking sector, but it is crucial to manage risk by diversifying.

Conclusion

In conclusion, the Bajaj Finserv Nifty Bank ETF (BANKBETF) has a diversified portfolio, steady growth rate, and moderate risk profile. The ETF’s technical indicators suggest a bullish trend, but also indicate that it may be due for a correction or consolidation. Investors considering this ETF should carefully evaluate their risk tolerance and consider diversifying their portfolios to mitigate potential risks.