For centuries, precious metals like gold and silver have been considered safe havens in times of economic uncertainty. Both metals are used to hedge against inflation, protect wealth, and offer long-term security. However, a long-standing debate continues to brew among investors: is it better to invest in silver or gold? While gold often dominates the conversation, there are compelling reasons why silver may be a more strategic investment. This blog will delve into the key advantages of investing in silver over gold, exploring affordability, industrial demand, historical performance, storage, volatility, and future trends.

Affordability and Accessibility

One of the most significant advantages silver has over gold is its affordability and accessibility. As of today, the price of gold is significantly higher than silver, often making it inaccessible for many investors. For example, while an ounce of gold might cost around $1,900, silver trades at a much lower price—around $23 per ounce. This substantial price difference means that for the cost of one ounce of gold, you could purchase nearly 82 ounces of silver.

This cost comparison highlights silver’s potential for higher returns relative to the investment size. For those just starting in the world of investing or those with smaller budgets, silver provides a more affordable entry point. New investors can accumulate more of this precious metal, allowing them to build a tangible portfolio without committing significant capital. Additionally, silver’s accessibility means investors can purchase it in smaller quantities, making it easier to buy, sell, or trade as needed.

Industrial Demand and Applications

While gold is predominantly used in jewelry and investment, silver plays a more versatile role in various industries. Silver is a critical component in electronics, solar panels, medical devices, and more. Its excellent thermal and electrical conductivity makes it indispensable in producing semiconductors, batteries, and touchscreens. The growing demand for renewable energy has also increased the need for silver, especially in photovoltaic cells used in solar panels.

In contrast, gold has limited industrial applications, primarily used in high-end electronics and some medical devices. This distinction gives silver a unique edge—its price is influenced not just by investor demand but also by industrial demand. The more our world moves toward technological advancements and renewable energy sources, the higher the demand for silver.

Moreover, silver’s price tends to be more sensitive to economic cycles than gold. During economic booms, the industrial demand for silver surges, driving prices up. This market sensitivity means that silver investors can see higher price appreciation during periods of economic growth, whereas gold remains relatively steady in comparison.

Historical Performance and Market Trends

When examining the historical performance of silver, it’s clear that this metal tends to outperform gold during bull markets. Over the past several decades, silver has experienced more significant price surges during bullish periods than gold, offering investors an opportunity for higher short-term returns. For example, during the bull market from 2009 to 2011, silver’s price increased by over 400%, whereas gold’s price increased by approximately 150%.

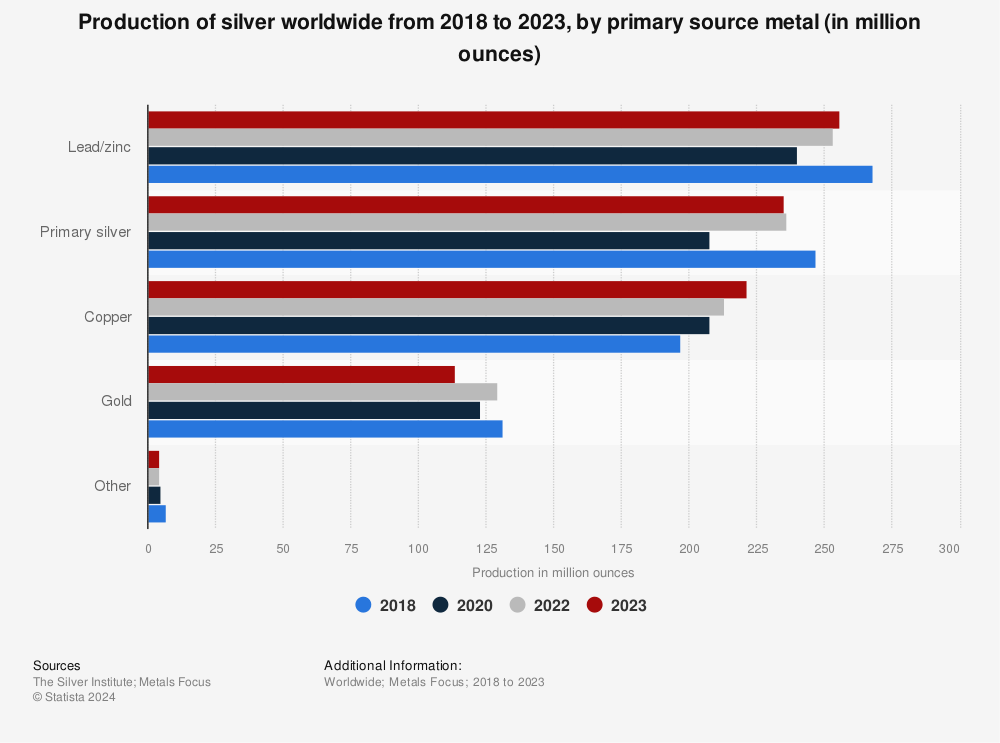

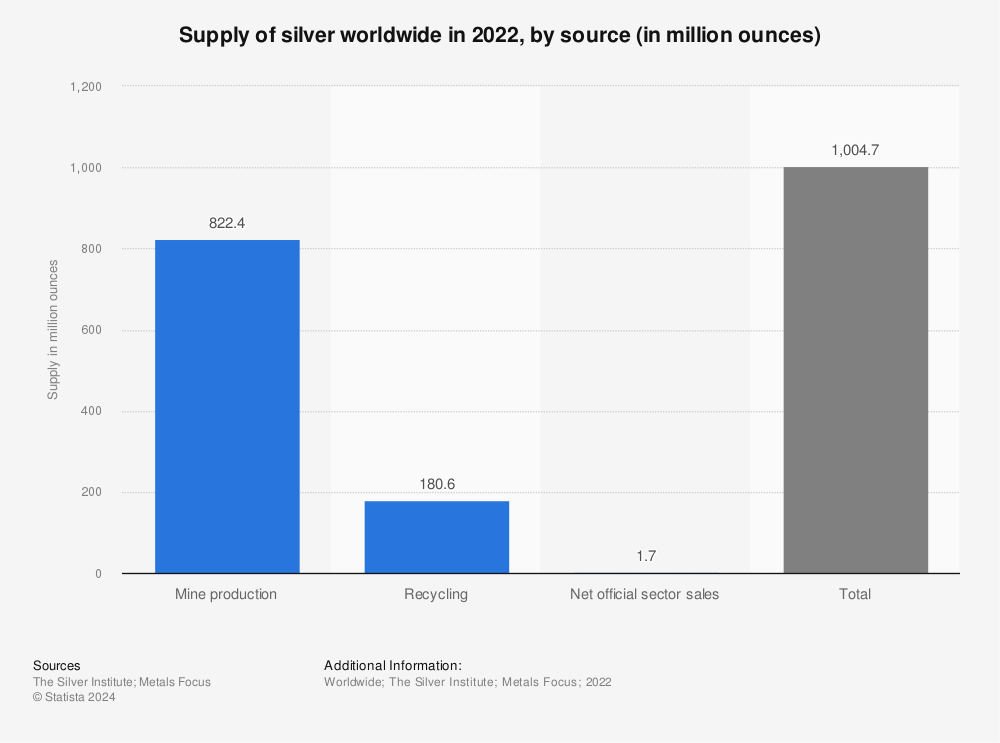

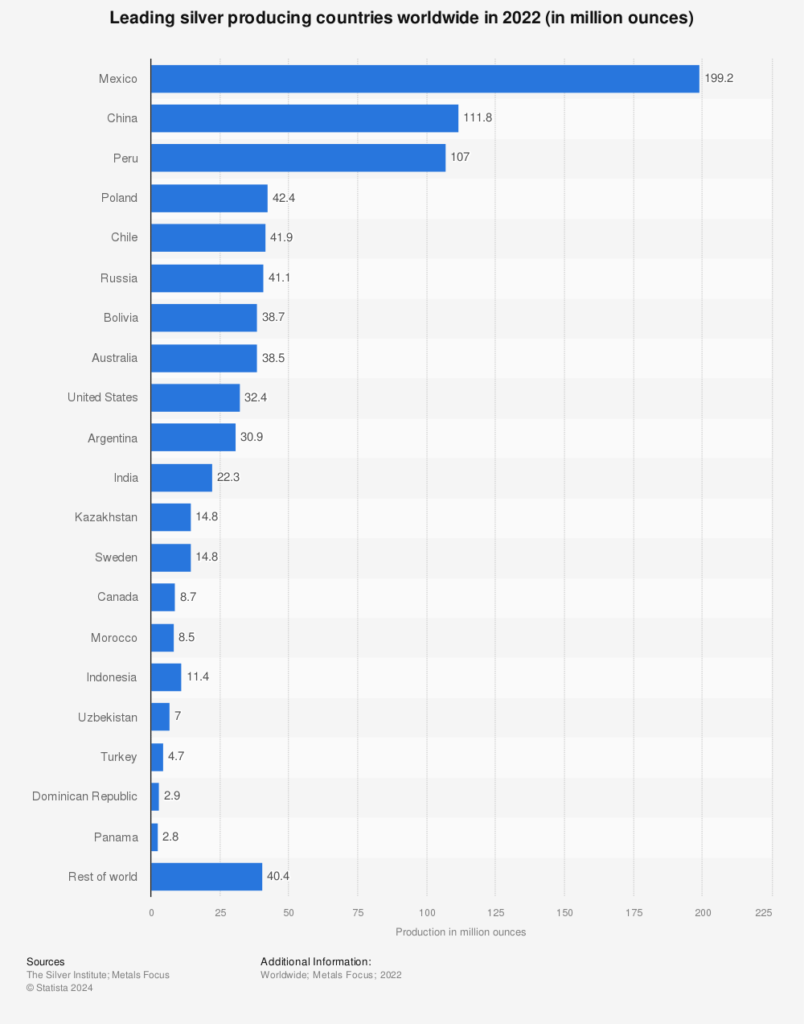

Additionally, the silver market is currently facing supply deficits, adding to its investment appeal. The extraction and mining of silver have become more challenging, and with the increasing industrial demand, the supply of silver is struggling to keep up. This mismatch between supply and demand suggests that silver prices may continue to rise in the long term, creating potential for even greater returns.

Storage and Practicality

One of the key considerations for precious metal investors is the storage requirements of their investments. While gold requires less space to store due to its higher value per ounce, silver, given its lower price, necessitates more storage space. For instance, storing 100 ounces of silver takes up significantly more space than 1 ounce of gold. However, modern storage solutions and vaulting services make it relatively easy and cost-effective to store silver in larger quantities.

Another concern with silver is its tendency to tarnish over time. Unlike gold, which is virtually immune to tarnishing, silver can develop a black layer of corrosion when exposed to air and sulfur. However, this issue can be easily remedied with proper storage techniques, such as vacuum-sealed containers or anti-tarnish bags.

When it comes to liquidity and usability, silver offers an advantage in smaller transactions. Silver is often used for fractional transactions, making it more practical for everyday purchases or barter situations. Gold’s high value per ounce makes it difficult to break down for smaller trades, whereas silver’s lower price allows for more flexibility.

Volatility and Investment Strategy

Silver is often considered more volatile than gold, which can be a double-edged sword. This market volatility can result in rapid price swings, both up and down. While this may seem risky, it also presents opportunities for savvy investors to capitalize on price fluctuations. During periods of market uncertainty or industrial expansion, silver prices can spike dramatically, offering short-term traders and long-term investors alike the potential for substantial gains.

To manage the risks associated with silver’s volatility, investors can adopt specific investment strategies. For instance, dollar-cost averaging—where investors regularly buy silver over time, regardless of price—helps smooth out the impact of market fluctuations. Another strategy is to allocate a portion of an investment portfolio to both silver and gold, balancing the higher risk of silver with gold’s relative stability.

Future Outlook

The future of silver looks particularly bright, thanks to its crucial role in renewable energy and technological advancements. As the world increasingly turns toward sustainable energy sources, the demand for silver is expected to skyrocket. Solar power, in particular, relies heavily on silver, and as more countries commit to reducing their carbon footprints, silver will continue to be a vital component in this green transition.

Beyond renewable energy, silver will play a significant role in future technological developments. From electric vehicles to 5G infrastructure, silver is an essential material in innovations that will shape the global economy in the coming decades. This increasing demand, coupled with supply constraints, positions silver as an attractive investment option for those looking toward the future.

Moreover, the growing interest in silver as an investment vehicle, especially among younger and environmentally conscious investors, suggests that silver’s role in global markets will continue to expand. As the world becomes more interconnected and reliant on technology, the demand for silver’s unique properties will likely grow, making it a promising long-term investment.

Conclusion

In summary, silver presents a compelling case for investors seeking a versatile, affordable, and high-potential asset. From its affordability and widespread industrial applications to its strong historical performance and bright future outlook, silver offers unique advantages over gold. While both metals have their place in a diversified portfolio, silver’s volatility, lower entry cost, and role in technological advancements make it a particularly attractive option for investors looking to capitalize on growth opportunities in the coming years.

By incorporating both silver and gold into an investment strategy, investors can benefit from the strengths of each metal, creating a balanced and resilient portfolio poised to thrive in a rapidly evolving economic landscape.