In the ever-evolving landscape of global economics, India stands as a beacon of progress according to the World Economic Outlook Database October 2023 Survey conducted by the International Monetary Fund (IMF). This survey unveils a narrative of remarkable strides towards prosperity, underscoring India’s unwavering commitment to innovation, collaboration, and sustainable growth. As the nation ardently pursues the ambitious goal of achieving a 5 trillion-dollar economy, the stage is set to explore the pivotal economic indicators shaping this trajectory. Join us as we unravel the intricate tapestry of India’s economic journey, guided by data and propelled by a vision of collective prosperity.

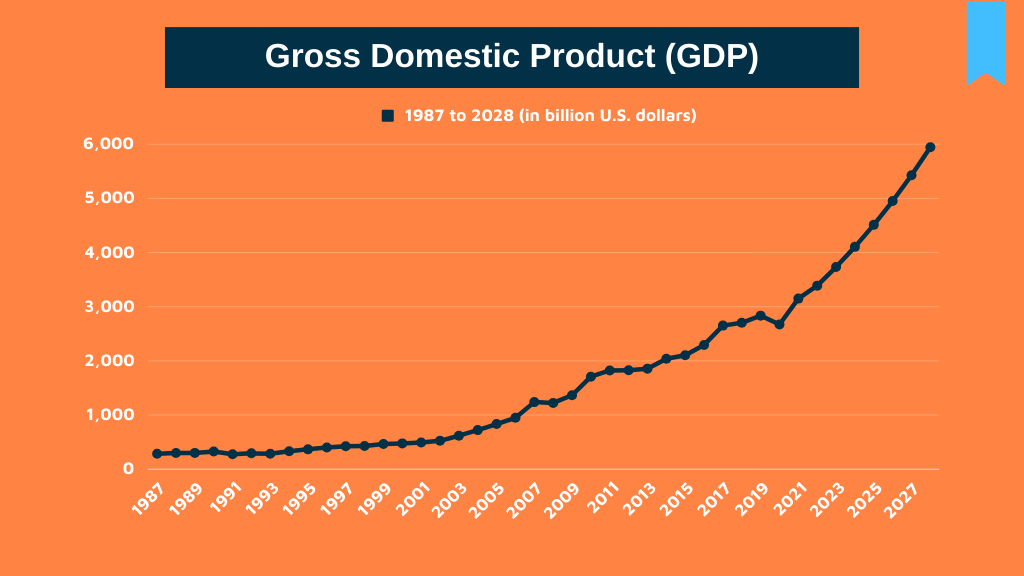

Gross domestic product (GDP) in India 2028

From 1987 to 2023, India’s GDP exhibited a compelling trajectory, culminating in a noteworthy 2.84 trillion U.S. dollars in 2019. The figures, extending to 2028, project an upward surge, aiming to reach an impressive 5.944 trillion U.S. dollars. This statistical narrative not only showcases India’s substantial economic growth but also invites a comparative analysis with Russia’s GDP. The intricacies of this data reveal a dynamic economic landscape, highlighting India’s resilience and ambition on the global stage.

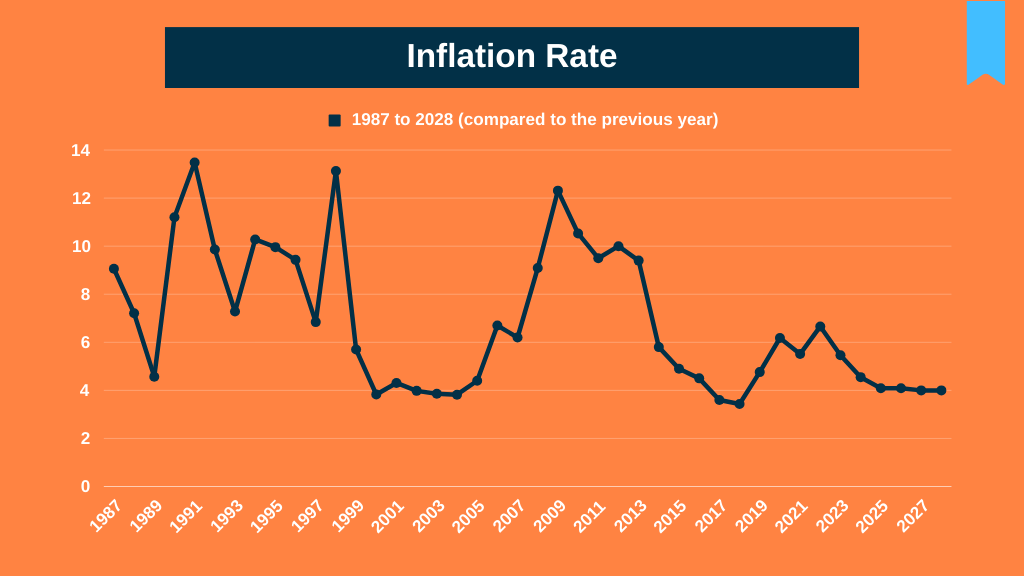

Inflation Rate

The inflation rate in India, a key economic gauge, fluctuated over the years, revealing economic dynamics. In 2023, it stood at 5.46%, reflecting a nuanced consumer spending landscape. Explore the figures from 1987 to 2028 to grasp the intricate dance of prices, from groceries to federal fees. Witness the story of India’s economic ebb and flow, providing crucial insights into the nation’s financial pulse. For a comprehensive view, check India’s economic growth figures, unlocking a deeper understanding of this inflationary tale.

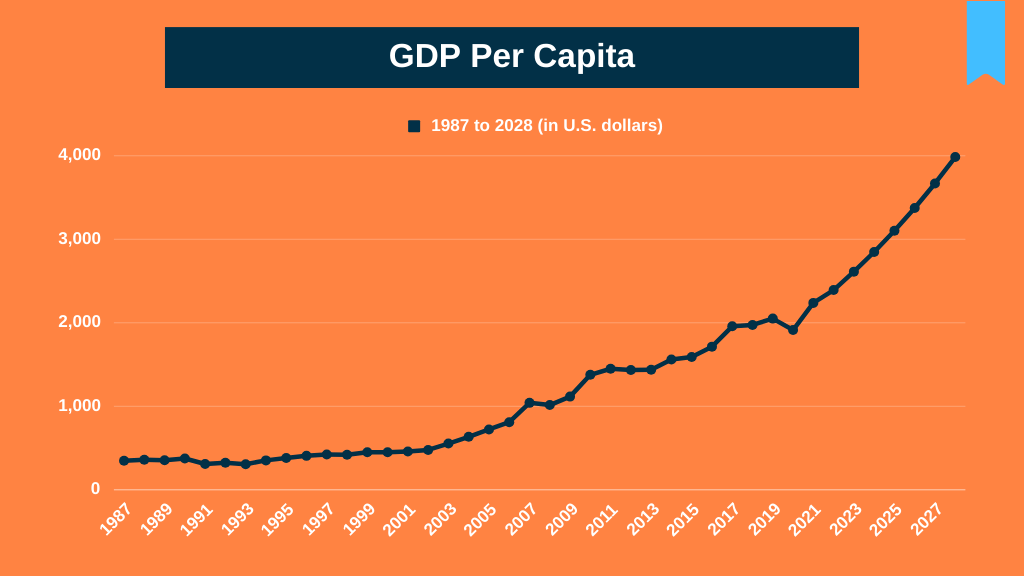

GDP Per Capita

The trajectory of India’s Gross Domestic Product (GDP) per capita unfolds from 1987 to 2028, capturing the nation’s economic pulse. In 2020, the estimated per capita GDP in India stood at $1,913.22, reflecting both challenges and potential. Explore the economic growth figures, unraveling the story of India’s financial evolution. For perspective, compare with China’s per capita GDP, which soared to $6,995.25 in 2013, offering insights into the diverse economic landscapes of these two influential nations.

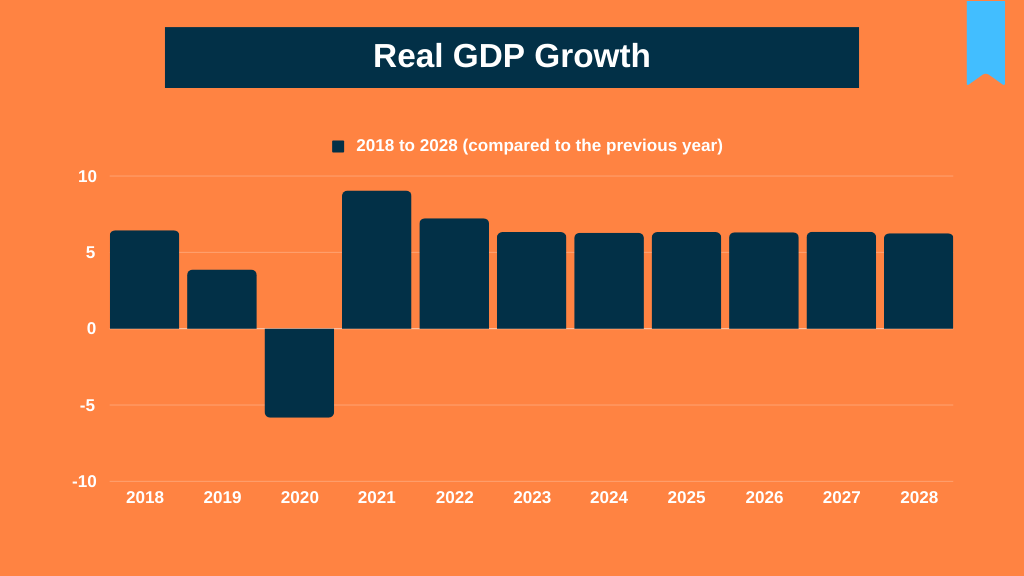

Real GDP Growth

India’s economic landscape, as depicted by the growth of real Gross Domestic Product (GDP) from 2018 to 2028, showcases a resilient trajectory. In 2023, the real GDP growth rate stood at an impressive 6.33%, signaling robust economic health. This crucial indicator, adjusted for price changes, serves as a barometer for India’s economic strength. Explore the figures and projections, revealing a nation consistently on the path of positive growth, positioning itself as a key player in the global economic arena.

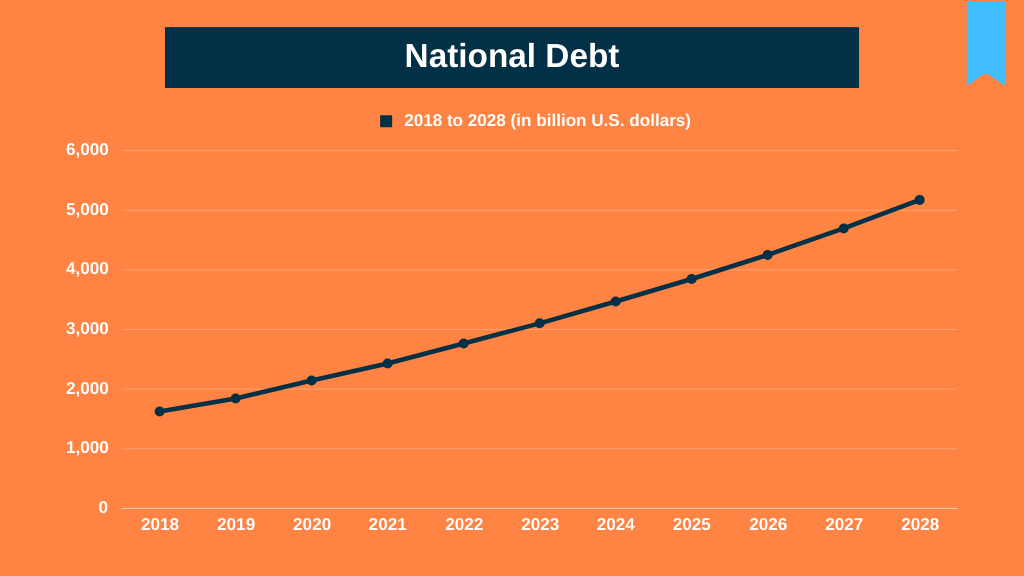

National Debt

In 2021, India’s national debt reached a significant 2.43 trillion U.S. dollars, marking a financial landscape in transition. Projections from 2018 to 2028 indicate a consistent upward trend, with each passing year witnessing a substantial increase. The figures, ranging from 1,626.17 billion U.S. dollars in 2018 to an estimated 5,174.80 billion U.S. dollars by 2028, underscore the fiscal challenges and strategic considerations that shape India’s economic future. Explore the evolving dynamics of India’s national debt, a key facet of the nation’s financial narrative.

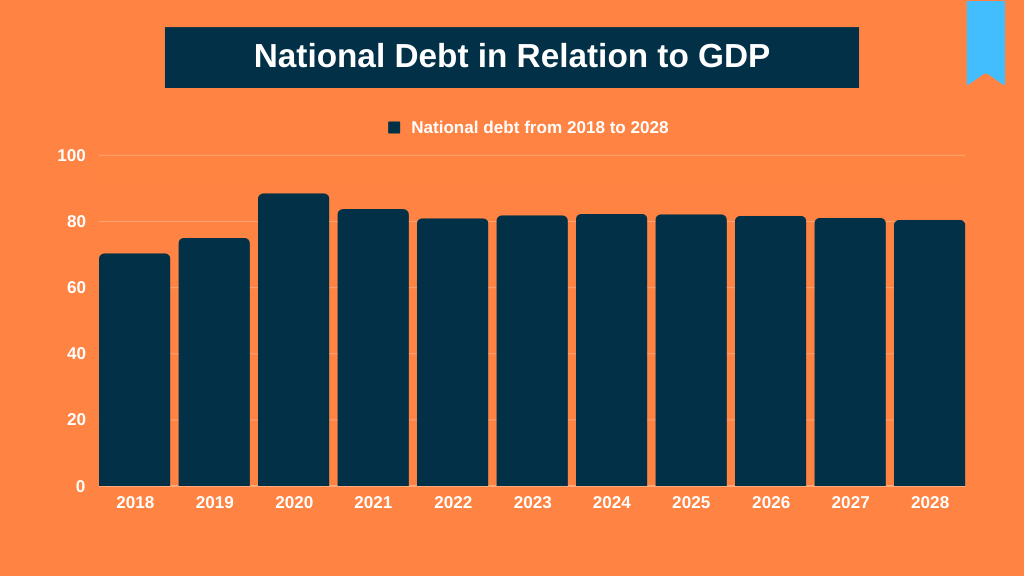

National Debt in Relation to GDP

From 2018 to 2021, India’s national debt in relation to Gross Domestic Product (GDP) witnessed fluctuations, reaching 83.75% in 2021. Projections through 2028 suggest a nuanced trajectory, with the debt-to-GDP ratio expected to hover around 80.50%. These figures highlight the delicate balance between fiscal responsibility and economic growth, offering insights into India’s strategic financial management amidst evolving global economic dynamics. Explore the intricate dance of national debt and GDP, a pivotal aspect of India’s economic narrative.

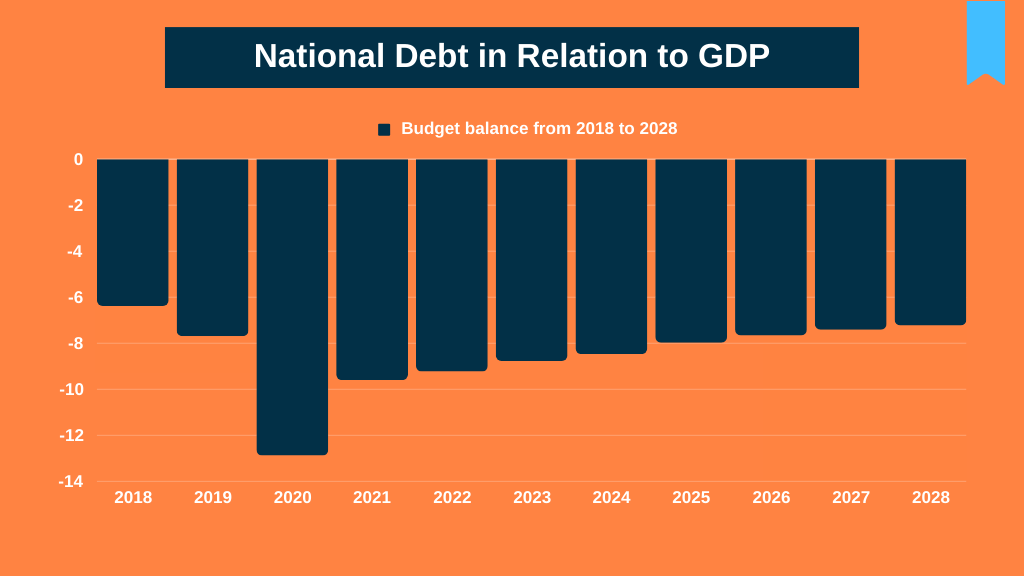

Budget Balance

Between 2023 and 2028, India’s budget balance in relation to Gross Domestic Product (GDP) is projected to incrementally increase by a total of 1.5 percentage points. According to this forecast, by 2028, the budget balance is expected to rise for the eighth consecutive year, reaching -7.23 percent. This indicator reflects the general government’s net lending/borrowing, calculated as revenue minus total expenditure. The trajectory highlights the delicate equilibrium between government finances and economic dynamics, offering a glimpse into India’s fiscal strategy amidst evolving global challenges.

Conclusion

In conclusion, India’s march towards the 5 trillion mark is not a solitary endeavor but a collective odyssey. By harnessing innovation, fostering collaboration, and ensuring sustainable growth, the nation paves the way for a robust economy that benefits all. This economic narrative, woven through GDP, inflation, per capita income, and fiscal responsibility, exemplifies the resilience and determination of a nation poised for unparalleled prosperity.

Please, God, you are so amazing! I don’t think I’ve ever read anything that remotely resembles it. What a relief it is to find someone who has newly conceived opinions regarding this matter. Taking the initiative to launch something is something that is really appreciated. On the internet, there is a significant need for someone who possesses some creative abilities, and this website offers that.

I do not even understand how I ended up here, but I assumed this publish used to be great

I enjoyed it just as much as you will be able to accomplish here. You should be apprehensive about providing the following, but the sketch is lovely and the writing is stylish; yet, you should definitely return back as you will be doing this walk so frequently.

Hi Neat post There is a problem along with your website in internet explorer would test this IE still is the market chief and a good section of other folks will pass over your magnificent writing due to this problem.

There is definately a lot to find out about this subject. I like all the points you made.