In the backdrop of geopolitical tensions and subdued global economic growth, the Indian stock market showcased remarkable resilience throughout 2023. Despite external challenges, both the Nifty 50 and BSE Sensex, India’s prominent stock indexes, recorded substantial gains, marking 2023 as their second-best year since 2017. This article provides an overview of the triumphs and nuances of the year, examining key indices, notable sectoral performances, and the market’s response to both domestic and global influences.

Nifty 50 and BSE Sensex Performance

In 2023, the Nifty 50 and BSE Sensex exhibited robust growth, with gains of around 20%. The Nifty soared by 3,600 points, culminating in a record high of over 21,800, while the Sensex witnessed a remarkable surge of 11,000 points, surpassing the 72,000-point milestone.

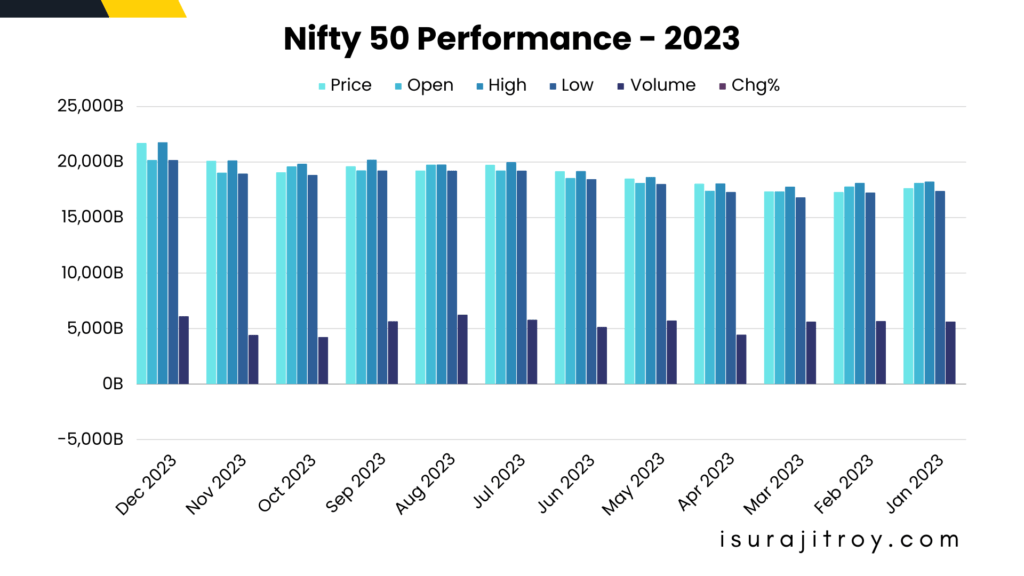

Nifty 50 Yearly Performance 2023

Summary: Highest21,801.45 | Lowest16,828.35 | Difference4,973.10 | Average18,975.36 | Chg. %20.03

In 2023, the Nifty 50 exhibited robust growth, marking it as one of the most successful years in recent times. The index soared by 3,600 points, culminating in a record high of over 21,800. Despite facing challenges, the Nifty 50 displayed remarkable resilience by surging over 28% from a low of 16,828 points in March, reaching a record high by the year-end. Additionally, sectoral indices demonstrated notable performances, with the Nifty Smallcap 100 surging by an impressive 54%, and the Nifty Midcap 100 jumping over 44%. The year concluded with the Nifty 50 reaching a historic high of 21,801 points on December 28, reflecting a 20.03% increase for the year.

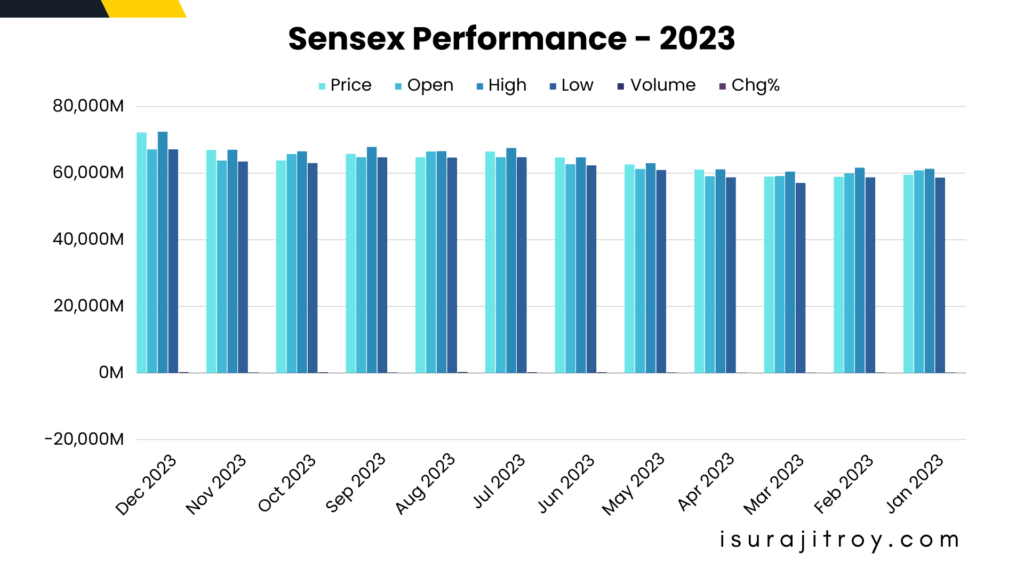

Sensex Performance for the Year 2023

Summary: Highest72,484.34 | Lowest57,084.91 | Difference15,399.43 | Average63,853.99 | Chg. %18.74

The BSE Sensex witnessed a remarkable surge of 11,000 points, surpassing the 72,000-point milestone in 2023. The index surged more than 18% throughout the year, reflecting the market’s momentum and positive sentiment. In December 2023, the Sensex reached an all-time high of 72,119.85 on December 27, emphasizing the broader market’s strength. Despite marginal year-end declines, the overall trajectory indicated a positive market sentiment, positioning the year as one of the most successful in recent times.

Milestones and Achievements

Alongside the overall market performance, various indices showcased impressive milestones:

- Nifty 50 Resilience: Bouncing back from a low of 16,828 points in March, the Nifty 50 displayed resilience by surging over 28% and reaching a record high of over 21,000 points by the year-end.

- BSE Sensex Momentum: The BSE Sensex surged more than 18% throughout 2023, reflecting the market’s momentum and positive sentiment.

- Sectoral Indices: The Nifty Smallcap 100 surged by an impressive 54%, and the Nifty Midcap 100 jumped over 44%.

Additionally, sectoral indices exhibited remarkable performances, with the Nifty Smallcap 100 soaring by an impressive 54%, and the Nifty Midcap 100 leaping over 44%. These substantial gains underscored the strength and vitality of smaller and mid-sized companies within the Indian equities market.

Record Highs and Nuanced Trends of 2023

In December 2023, both the Nifty 50 and Sensex reached extraordinary highs. The Nifty attained a record peak of 21,801 points on December 28, registering a 20.03% increase for the year. Simultaneously, the Sensex reached an all-time high of 72,119.85 on December 27, emphasizing the broader market’s strength. As the month concluded, marginal declines were observed, with the Sensex closing 0.23% lower at 72,240.26 points and the Nifty 50 closing 0.22% lower at 21,731.40 points on December 29. Despite these marginal corrections, the overall trajectory indicated a positive market sentiment.

Market Cautions and Opportunities

Amidst manufacturing challenges, the month’s end witnessed marginal declines in the stock market indices. The Sensex concluded 0.23% lower at 72,240.26 points, while the Nifty 50 closed 0.22% lower at 21,731.40 points on December 29. Despite these slight corrections, the broader trajectory suggested an underlying positive market sentiment. Investors remained cautiously optimistic, navigating through manufacturing hurdles while maintaining confidence in the market’s resilience and potential for future growth.

Manufacturing PMI and Year-Ahead Outlook

The HSBC India purchasing managers’ index for manufacturing witnessed a decline, hitting 54.9 in December, marking an 18-month low. This dip signals potential short-term challenges for the manufacturing sector, underlining concerns about current operational conditions. However, amidst these hurdles, the year-ahead outlook surged to a three-month high, showcasing resilience within the market. This optimistic projection indicates a broader confidence in the sector’s ability to overcome immediate obstacles, suggesting a hopeful trajectory for future growth and stability.

Global Parallels and Economic Factors

Manufacturing Challenges: Global Economic Landscape: Amid the intricate tapestry of global economic dynamics, the trajectory of the Indian stock market in 2023 echoed resonant patterns seen across international counterparts. Shared experiences in confronting multifaceted challenges and seizing emerging opportunities underscored the interconnectedness of economies worldwide. Despite nuanced differences, the Indian market mirrored broader global trends, illustrating the profound impact of global economic forces on local market sentiments and investment strategies. In this intricate dance of global commerce, the Indian stock market served as both a barometer and a participant, navigating the ebbs and flows of the global economic tide with keen vigilance and adaptability.

Market Expectations and Cautionary Notes

Market experts foresee a promising outlook for 2024, projecting a further 9% increase in India’s stock market despite signs of a gradual economic deceleration. This optimistic forecast underscores the market’s resilience and potential for sustained expansion. However, cautionary notes from experts emphasize the need for vigilance against potential headwinds. These concerns include decelerating growth, liquidity constraints, regulatory ambiguities, and intensified competition from other emerging markets. Prudent risk management strategies are imperative to navigate the market’s uncertainties and capitalize on its growth opportunities in the coming year.

Market Strengths and Challenges

The market’s foundation was fortified by strong corporate earnings, robust economic recovery, and the implementation of supportive monetary and fiscal policies. However, the journey was not devoid of challenges, with the market contending with elevated inflation, rising interest rates, geopolitical tensions, and valuation concerns.

1. Strong Corporate Earnings

Corporate earnings showed resilience and strength, contributing to the market’s foundation by indicating the profitability and health of businesses across various sectors.

2. Robust Economic Recovery

The market benefited from a robust economic recovery, characterized by increasing GDP growth, rising consumer spending, and improved business sentiment, fostering optimism among investors.

3. Supportive Monetary and Fiscal Policies

The implementation of supportive monetary and fiscal policies by authorities bolstered the market’s foundation, providing liquidity support, stimulating demand, and fostering conducive conditions for investment and growth.

4. Elevated Inflation

The market grappled with elevated inflation levels, which posed challenges by eroding purchasing power, impacting consumer sentiment, and potentially leading to higher operating costs for businesses.

5. Rising Interest Rates

Rising interest rates presented challenges for the market, affecting borrowing costs, investment decisions, and the valuation of assets, potentially leading to adjustments in asset allocation strategies.

6. Geopolitical Tensions

Geopolitical tensions added to market uncertainties, with events such as trade disputes, geopolitical conflicts, and diplomatic tensions affecting investor confidence and introducing volatility into financial markets.

7. Valuation Concerns

Market participants faced valuation concerns as asset prices reached elevated levels, prompting considerations about the sustainability of valuations and potential corrections in asset prices based on fundamental factors.

Indian Share Market Outlook for 2024

As the year concluded, experts sounded a note of caution for the market’s outlook in 2024. Potential headwinds, including slowing growth, tightened liquidity, regulatory uncertainties, and heightened competition from other emerging markets, raised concerns among market observers.

Banks: With an anticipated economic recovery in 2024, banks are poised to benefit from increased lending activities and improved credit quality, contributing to overall sector growth.

Healthcare: The healthcare sector is expected to thrive in 2024, propelled by rising health consciousness among consumers and sustained demand for healthcare services, including pharmaceuticals and medical devices.

Energy: Amid global shifts towards renewable energy sources, the energy sector in India is expected to witness growth opportunities, driven by investments in clean energy projects and government initiatives promoting sustainability.

Automobiles: Following disruptions in supply chains, the automobile sector is forecasted to rebound in 2024, supported by recovering demand, new product launches, and technological advancements in electric vehicles.

Retailers: Consumer spending trends are anticipated to drive growth in the retail sector, with retailers benefitting from evolving consumer preferences, omnichannel strategies, and innovative retail technologies.

Real Estate: Despite market fluctuations, the real estate sector remains resilient in 2024, with potential growth opportunities fueled by urbanization, infrastructure development, and government initiatives promoting affordable housing.

Telecoms: With increasing connectivity demands and ongoing technological advancements, the telecom sector is expected to expand in 2024, driven by investments in 5G infrastructure, digital transformation initiatives, and rising internet penetration rates.

Conclusion

In conclusion, the Indian stock market’s performance in 2023 is a testament to its resilience and capacity for growth even in challenging global scenarios. Investors should approach the nuanced economic landscape with cautious optimism, considering short-term challenges and long-term growth potential. Diversification, thorough research, and an understanding of global and domestic dynamics remain essential for navigating uncertainties and making informed investment decisions.