India stands as a key powerhouse in the realm of diamond imports, a pivotal player in the global diamond industry. Renowned for its intricate craftsmanship and robust trade, India’s significance in the diamond market is unparalleled.

Global Statistics

- Global Diamond Purchases in 2022: Totaled a substantial US$126.1 billion.

- Decline in Diamond Purchases: Since 2018, there was an average decrease of -3.6% in the overall value of diamonds bought by importing countries, dropping from $130.8 billion.

- Yearly Increase in Diamond Spending: Notably, in 2021, the total expenditure on imported diamonds saw a positive upturn of 5.1%, reaching $120 billion.

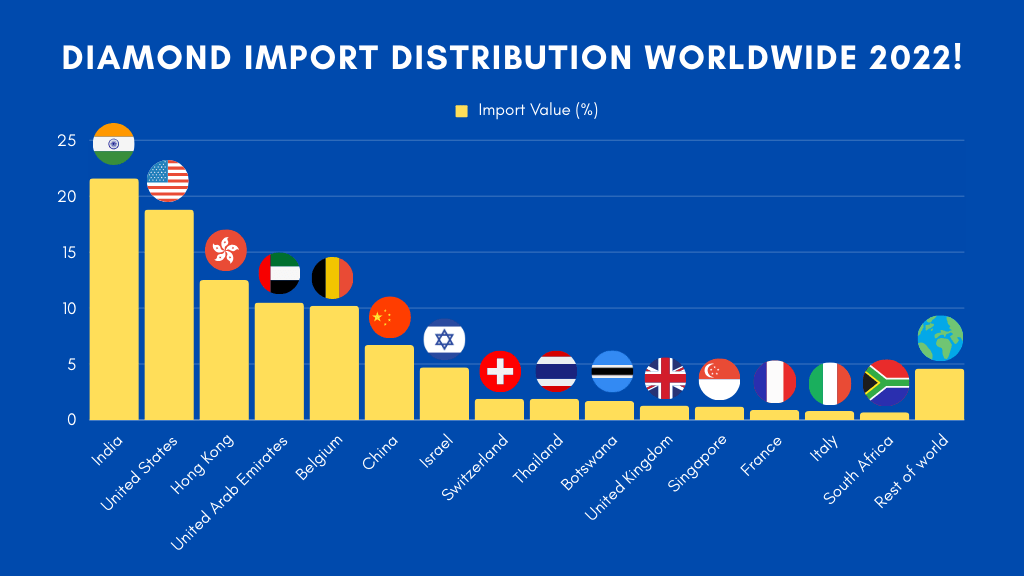

- Top 5 Buyers of Imported Diamonds: Comprised India, United States of America, Hong Kong, United Arab Emirates, and Belgium, collectively accounting for 73.6% of all internationally sold diamonds in 2022.

- Continental Perspective on Diamond Imports: Asian countries led the chart, spending $77.7 billion, equivalent to 61.8% of the global total. North American importers followed at 19.3%, with European countries at 15.7%.

- Smaller Percentage Allocations: African countries accounted for 2.7%, Oceania (led by Australia and New Zealand) at 0.4%, and Latin America (excluding Mexico but including the Caribbean) at 0.2% of worldwide diamond imports.

Diamond import distribution worldwide 2022

In 2022, India saw a significant influx of diamonds from various corners of the globe. The top 15 suppliers contributing to India’s thriving diamond imports showcased an intricate tapestry of trade dynamics. Notably, these contributing nations witnessed diverse changes in the value of their supplied diamonds from 2021 to 2022.

- Top 15 Countries in Diamond Imports (2022):

- India led the imports at US$27.3 billion (21.6%).

- Following were the United States at $23.7 billion (18.8%), Hong Kong at $15.7 billion (12.5%), United Arab Emirates at $13.3 billion (10.5%), and Belgium at $12.8 billion (10.2%).

- Fastest-Growing and Declining Markets:

- Fastest-growing markets for diamonds since 2021 were France (up 65.2%), Singapore (up 42.9%), Thailand (up 34.2%), and Switzerland (up 33.7%).

- Declines were seen in Botswana (down -25.1%), mainland China (down -14.3%), United Arab Emirates (down -9.8%), and Israel (down -4.3%).

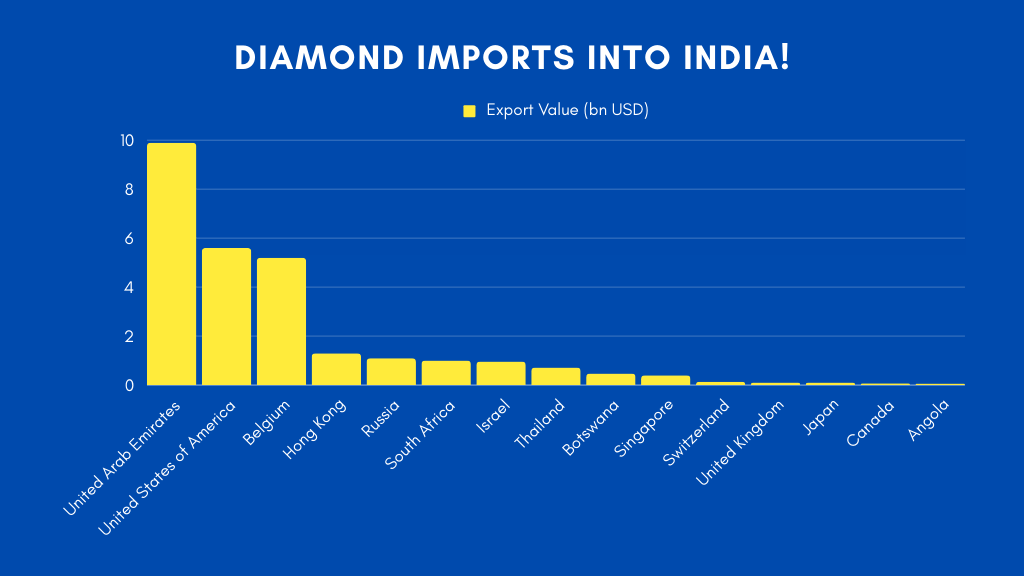

Diamond Imports into India

The top 15 diamond suppliers contributed significantly to India’s 2022 imports, demonstrating value and trade movements. The UAE lead the diamond trade list at US$9.9 billion, highlighting significant improvements. Switzerland, Singapore, Thailand, and Russia were India’s fastest-growing suppliers, while Hong Kong, Japan, Angola, and Botswana declined. While fluctuations occurred, India’s diamond imports rose 3.9% annually to $26.3 billion in 2021.

- Top 15 Suppliers and Percentage Changes in Diamond Value (2022 to 2021):

- United Arab Emirates: US$9.9 billion (up 13.5%)

- United States of America: $5.6 billion (up 2.9%)

- Belgium: $5.2 billion (down -2.1%)

- Hong Kong: $1.3 billion (down -39%)

- Russia: $1.1 billion (up 26.4%)

- South Africa: $1 billion (up 11.2%)

- Israel: $961.3 million (down -18.9%)

- Thailand: $714.8 million (up 68.4%)

- Botswana: $472 million (down -19.1%)

- Singapore: $401.6 million (up 225.2%)

- Switzerland: $142.7 million (up 924.1%)

- United Kingdom: $101.5 million (down -4.9%)

- Japan: $99.2 million (down -30%)

- Canada: $67.3 million (down -15.6%)

- Angola: $64.4 million (down -22.4%)

- Fastest-Growing Suppliers to India:

- Switzerland (up 924.1%)

- Singapore (up 225.2%)

- Thailand (up 68.4%)

- Russia (up 26.4%)

- Countries with Declining Diamond Value Supplied to India:

- Hong Kong (down -39%)

- Japan (down -30%)

- Angola (down -22.4%)

- Botswana (down -19.1%)

- Overall Increase in India’s Diamond Imports:

- Average rise of 3.9% in the value of diamonds imported by India since 2021, when the total cost was $26.3 billion.

Diamond Production

- In the fiscal year 2020, the production volume of diamonds in India totaled over 28 thousand carats, which was the second-lowest production in recent years.

- The production value of diamonds in India was INR 1,800 crore (approximately $240 million) in the financial year 2021.

- Diamond mining in India extends back into antiquity. From ancient times, India was the source of nearly all the world’s known diamonds, and until the discovery of diamonds in South Africa in 1896, India was the only place where diamonds were mined. India has not been a major diamond-producing country since the 1900s, but diamond mining continues. In 2013, India mined 37,515 carats of diamonds, from one industrial-scale mine and many artisanal mines; this was less than one-tenth of one percent of the world production of 132.9 million carats.

India’s Diamond Dominance

India’s role in the global diamond trade extends beyond mere imports. The nation’s prowess in diamond cutting and polishing has become the bedrock of its dominance. Leveraging a cost-effective process, India not only stands as the largest exporter of diamonds globally but also significantly contributes to the burgeoning market of lab-grown diamonds.

Diamond Cutting and Polishing:

India’s proficiency in the art of diamond cutting and polishing is exemplary. The cost-effective process deployed in this phase of production has solidified India’s standing as a global leader.

World’s Largest Exporter:

India’s designation as the largest exporter of diamonds is a testament to its industry expertise and global reach.

Contribution to Lab-Grown Diamond Production:

India’s pivotal role in the burgeoning market of lab-grown diamonds is notable, signifying a forward-thinking approach to industry evolution.

India’s Future Outlook

India’s foray into the lab-grown diamonds market signals a proactive step toward diversification and modernization. The country’s progress in this domain underscores its commitment to innovation.

Challenges Faced by India’s Diamond Industry:

The industry faces challenges ranging from market fluctuations to geopolitical sanctions. Notably, the response to Western sanctions against Russian diamonds has compelled India to adapt and diversify its supply chains.

India’s Venture into Lab-Grown Diamonds:

India’s strides in the lab-grown diamonds market signify a promising future, augmenting the country’s position as a pioneer in innovation within the diamond trade.

Conclusion

India’s diamond industry commands global recognition for its import dominance, cutting-edge craftsmanship, and contributions to the evolving landscape of lab-grown diamonds. The nation’s ongoing evolution is poised to shape the future of the diamond industry.

India’s capacity to shape the future of the diamond industry in Google search results is unmistakable, underscoring its enduring global leadership.

Source : World’s Top Exports