Disclaimer: The information contained in this document is for educational and informational purposes only and should not be construed as investment advice. I am not registered with the Securities and Exchange Board of India (SEBI) as a financial advisor. This is not a recommendation to buy or sell any security. Before investing in any security, you should consult with a qualified financial advisor to determine if the investment is suitable for your investment objectives and risk tolerance. Investing in the stock market is subject to market risks.

An Exchange-Traded Fund (ETF) is a type of investment fund that holds a diversified portfolio of assets, such as stocks, bonds, or commodities, and trades on an exchange like a stock. Unlike mutual funds, which are priced only at the end of the trading day, ETFs can be bought and sold throughout the trading day at market prices. This feature provides investors with flexibility, liquidity, and often lower expense ratios compared to traditional mutual funds.

The Role of an MTF Broking Account

A Margin Traded Fund (MTF) broking account is a pivotal tool for ETF trading. This type of account allows investors to borrow funds from their broker to purchase ETFs, thereby leveraging their investment. Leveraging magnifies both potential gains and losses, necessitating meticulous risk management. An MTF account can significantly increase purchasing power, enabling traders to capitalize on market opportunities more effectively.

Choosing the Right ETF

High Momentum ETF

Selecting ETFs with high momentum is crucial. These ETFs exhibit strong and consistent upward price trends, indicating robust performance and investor confidence. High momentum ETFs are often driven by favorable economic conditions, sectoral strength, or specific asset performance.

Sustainable ETF

Sustainable ETFs are those that adhere to Environmental, Social, and Governance (ESG) criteria. Investing in these ETFs aligns with ethical investing principles and supports companies committed to sustainable practices. Sustainable ETFs can also attract a growing base of socially conscious investors, potentially enhancing their performance.

High Trading Volume ETF

High trading volume ETFs ensure better liquidity and price efficiency. High volume indicates active investor participation, reducing the risk of price manipulation and allowing for smoother transactions. Investors should prioritize ETFs with substantial daily trading volumes to facilitate easy entry and exit from positions.

Looking for high volume and high momentum ETF analysis? Tag me on Twitter (X) at @isurajitroy for expert insights and actionable strategies!

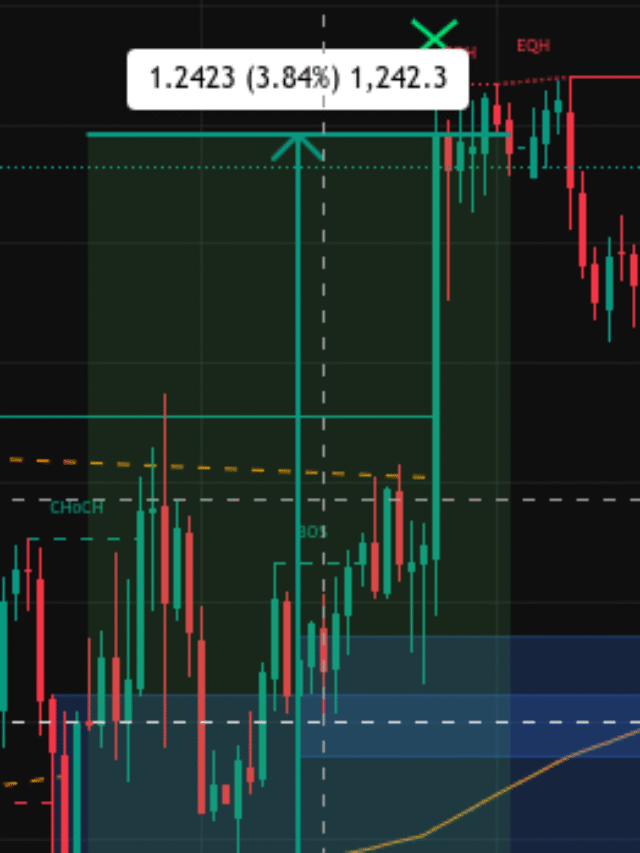

Stock Selection Strategy

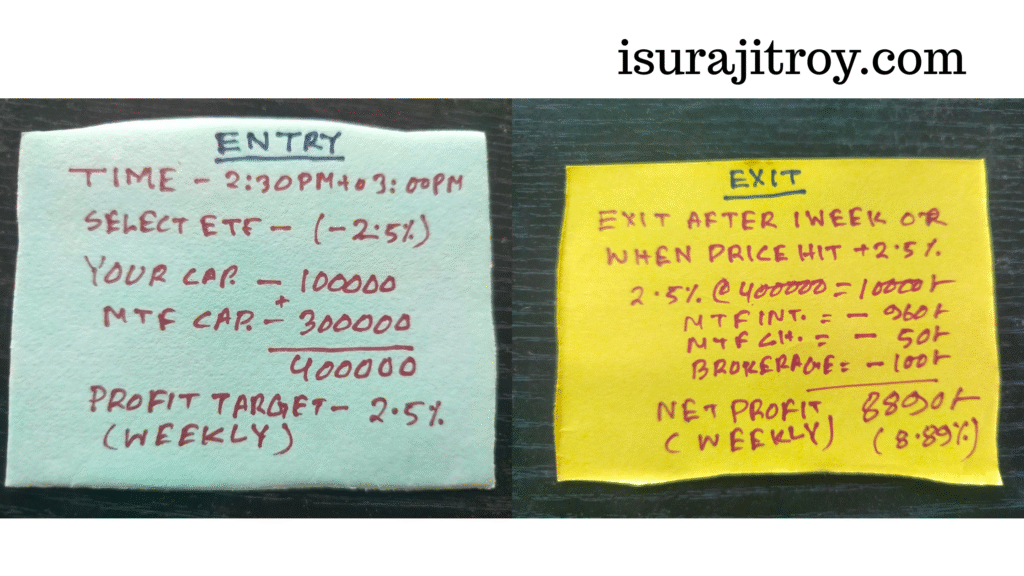

A strategic approach to selecting ETF stocks involves monitoring the market between 2:30 PM and 3:15 PM. Identifying ETF stocks that have declined by more than 2.5% during the day may present buying opportunities, as these stocks could be in oversold conditions, poised for a potential rebound.

Setting Profit Targets

Establishing a clear profit target is essential for disciplined trading. A weekly profit target of 2.5% provides a tangible benchmark for success. This target helps traders make informed decisions about when to enter and exit trades, ensuring consistent profitability while managing risk effectively.

Risk Management

Effective risk management is paramount in ETF trading. Implementing strategies such as stop-loss orders can limit potential losses by automatically selling a security when its price falls to a predetermined level. Diversifying the ETF portfolio across different sectors and asset classes can also mitigate risk by reducing exposure to any single investment.

Profit Calculation Example

Consider an initial capital of Rs. 1 lakh. With an MTF account, this amount can leverage up to Rs. 4 lakh worth of ETF stocks. A weekly profit target of 2.5% would yield Rs. 10,000 per week. After accounting for interest and brokerage charges, estimated at Rs. 2,500, the net profit would be Rs. 7,500 per week or Rs. 30,000 per month.

Tax Implications

Understanding the tax implications is crucial for ETF traders. According to the 2024 Indian Union Budget, short-term capital gains tax (STCG) on ETF profits is set at 20%. For consistent monthly profits of Rs. 30,000, the annual profit would amount to Rs. 360,000. Consequently, the applicable STCG would be Rs. 72,000, impacting the net annual income.

Conclusion

Generating regular monthly income through ETF trading is achievable with careful planning and disciplined execution. Selecting the right ETFs, employing robust risk management strategies, and setting clear profit targets are essential components of a successful trading strategy. While leveraging an MTF account can amplify profits, it is equally important to understand the associated risks and tax implications. By adhering to these principles, investors can navigate the complexities of ETF trading and achieve their financial goals.

By leveraging the right strategies and maintaining a disciplined approach, investors can effectively earn regular monthly income from ETF trading.